The global economic landscape has been rattled as US President Donald Trump announced a 25% tariff on all Indian imports, effective August 1, 2025. This unprecedented move marks the most significant escalation in trade tensions between Washington and New Delhi in recent memory.

Citing India’s rigid trade barriers and its energy and defense ties with Russia, Trump’s decision introduces a new flashpoint in what was, until recently, a steadily growing partnership. The implications are both economic and geopolitical, with ripple effects felt across global supply chains.

Why Did the US Impose Tariffs?

After months of stalled negotiations, the US-India trade dialogue collapsed in June 2025. Despite multiple summits and technical consultations, two sticking points proved insurmountable:

1. Indian Trade Barriers Remain High

The United States has long criticized India’s high tariff regime. Sectors like dairy, agriculture, and tech hardware have seen tariffs upward of 50%, deterring American companies. Additionally, non-tariff barriers like lengthy licensing and localization mandates have added to the frustration of US exporters.

2. India’s Growing Ties with Russia

While the West has imposed sweeping sanctions on Moscow for the ongoing war in Ukraine, India has expanded energy purchases from Russia. In his official statement, Trump accused India of “undermining global peace efforts” by continuing to fuel its economy with Russian oil.

“India is our ally… yet they remain the largest purchaser of energy from Russia. This must stop.”

— President Trump, July 2025

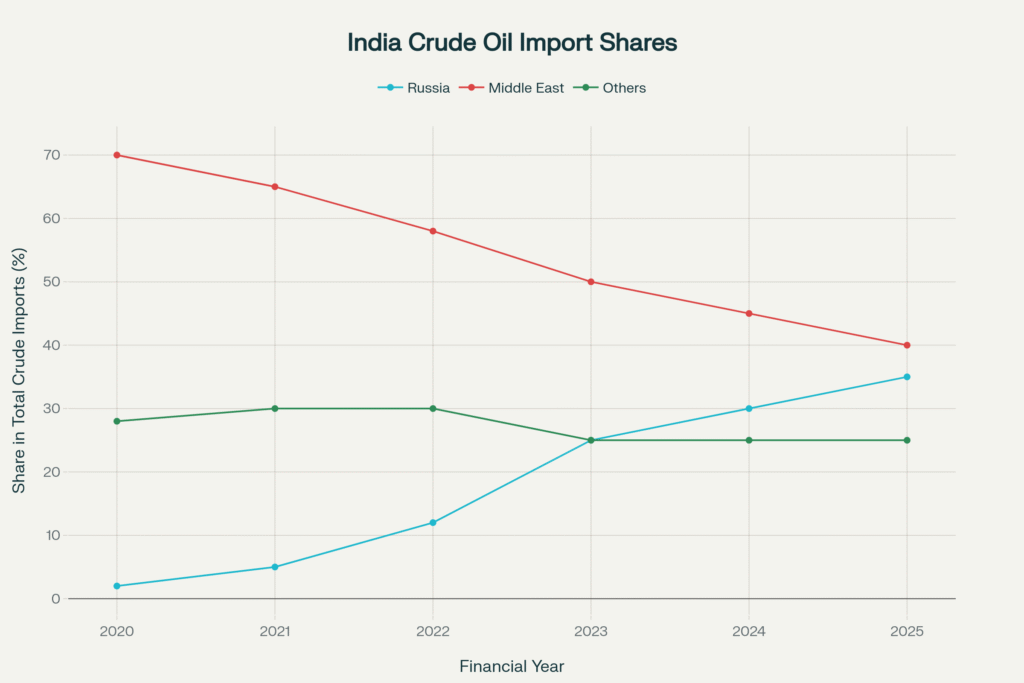

India’s Russian Energy Ties: Just How Deep?

India’s energy policy is guided by pragmatism, not politics. Since FY20, its imports from Russia have exploded:

- Russian crude accounted for 35–38% of India’s oil imports in FY25—up from just 2% five years ago.

- India’s oil import dependency stands at 88.2%, driven by low domestic production and surging demand.

- Refinery upgrades in India allow processing of heavy Russian blends—an economic advantage.

- The import bill for Russian crude has grown at a staggering 96% CAGR since FY20.

For a country navigating an energy-hungry growth path, Russian oil provides cost, volume, and stability—particularly when Middle Eastern supplies remain volatile.

Which Indian Export Sectors Are Hit the Hardest?

The 25% US tariff affects every Indian export, but some sectors are more vulnerable than others:

1. Electronics & Smartphones

India has recently overtaken China as the top supplier of iPhones to the US.

Now, production costs could surge, discouraging contract manufacturers from expanding Indian operations.

2. Pharmaceuticals

With razor-thin profit margins, India’s $13 billion pharma exports to the US will take a direct hit.

Generics and API suppliers now face profitability challenges, especially smaller firms.

3. Textiles & Apparel

The US is India’s largest textile buyer, accounting for 28% of garment exports.

Tariffs may push American buyers toward Bangladesh or Vietnam, endangering millions of Indian jobs.

4. Gems & Jewellery

This luxury export segment is sensitive to pricing. A 25% hike may cripple competitiveness, especially against Southeast Asian exporters.

5. Auto Parts, Machinery & Chemicals

These capital and industrial goods will see contract losses, order pullbacks, and a re-routing of investments to cheaper zones.

Global Supply Chains in Turmoil

The US move hits at a time when India was poised to become a manufacturing hub alternative to China. However:

- Vietnam, Philippines (20% average US tariff) and EU nations (15%) now look more attractive.

- Even Indonesia and Malaysia, facing lower or similar tariffs, may benefit from trade redirection.

- Apple’s “China Plus One” strategy, which heavily favored India, may slow down or pivot elsewhere.

Indian pharma, tech, and auto supply chains—deeply integrated with global flows—now face a cost disadvantage and regulatory unpredictability.

India’s Strategic Calculus: Energy First, Then Diplomacy

Despite repeated US warnings, India is unlikely to abandon its Russia ties entirely. Why?

- Security > Optics: With instability in the Middle East and Red Sea, Russian oil is both affordable and stable.

- Clean Energy Push: India met its 20% ethanol blending goal in 2025, six years ahead of target. But it needs crude to support urban growth and energy needs in rural regions.

- LNG Diversification: Ironically, the US is India’s second-largest LNG supplier—demonstrating India’s multi-polar energy strategy.

Secondary Sanctions on the Horizon?

The US Congress is deliberating the “Sanctioning Russia Act of 2025”, which includes:

- Secondary sanctions on countries buying Russian energy or defense equipment.

- A 500% tariff threat on specific goods linked to Russian-origin energy.

Though the bill hasn’t passed, its intent is clear: force compliance via economic pressure.

The EU’s own tightening saw Indian refined product exports to Europe drop 27% in 2025.

India now faces a dual challenge—accessing oil and maintaining exports.

Trade Talks and Diplomatic Breakdown

Fifth Round of Talks Fails

Negotiations fell apart in July, with mutual accusations:

- US calling India “protectionist” and “non-reciprocal”

- India accusing the US of “unilateral coercion”

Sixth Round Scheduled — But Unlikely to Succeed

Set for late August 2025, insiders say there is little optimism. Trump’s hardline stance enjoys bipartisan support.

India’s Response

In an official release, India called the tariffs “unjustified and detrimental,” and signaled possible:

- Retaliatory tariffs

- WTO appeals

- Bilateral sanctions reviews

What’s Next? Scenarios and Strategic Shifts

Short-Term (Next 6 Months)

- Expect a drop in Indian exports to the US, especially in textiles, pharma, and electronics.

- Small manufacturers and MSMEs in India may struggle with shrinking order books.

Mid-Term (2026–27)

- India will diversify energy and export markets—look toward Africa, ASEAN, and Central Asia.

- US firms with Indian manufacturing bases may lobby for exemptions or tax credits.

Long-Term (2028 and Beyond)

- A structural decoupling between US and Indian economies is possible.

- The emergence of regional economic blocs—India aligning more with BRICS+, while the US consolidates friend-shoring networks.

Conclusion

The 25% US tariff on Indian imports is more than a trade barrier—it’s a geopolitical marker. It signals the arrival of a new era where economic decisions are tightly interwoven with security alignments.

For India, energy independence and economic growth are non-negotiable. For the US, trade is now a weapon of diplomacy, especially against countries perceived to be soft on adversaries like Russia.

As the world watches the August 1 deadline arrive, businesses, policymakers, and diplomats must ask:

Is this the new normal? Or just a painful negotiation tactic in a changing global order?

Operation Mahadev: Indian Army Tandav Nritya On Terrorism