The latest wave of tariffs, diplomatic drama, and high-stakes defense snubs have sent India-US and Pakistan-US relations spinning in surprising new directions. It’s clear that this saga carries huge implications for global trade, security, and South Asia’s power dynamics.

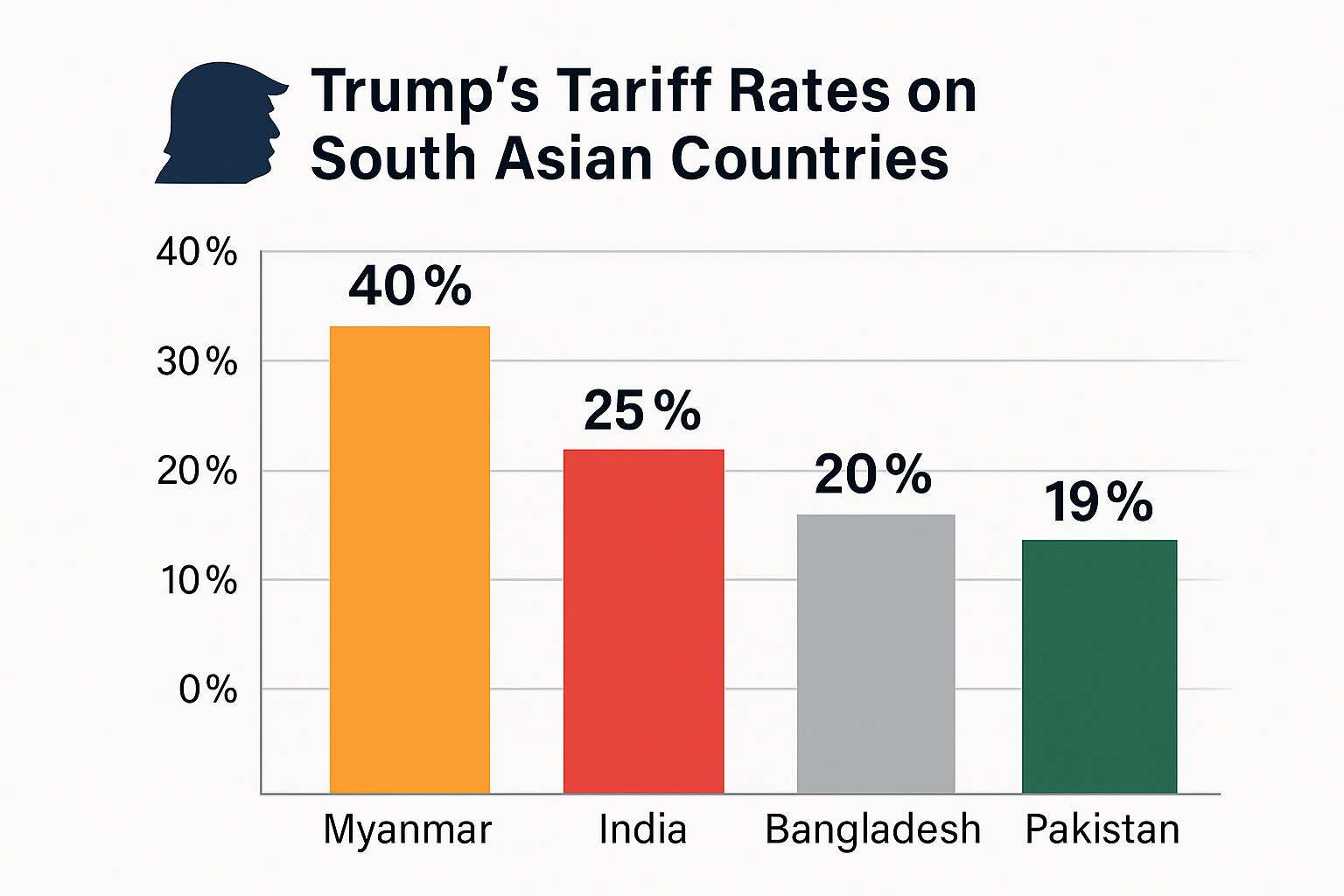

Trump’s Tariff Blitz: The Numbers

India: 25% Tariff Remains

President Donald Trump slapped a harsh 25% tariff on Indian exports to the US. This is not just any tariff—the rate is stiffer than those imposed on nearly every other South Asian neighbor, such as Bangladesh (20%) or Pakistan (now just 19%). Myanmar is the notable exception, at 40%.

Pakistan: Tariff “Surprise”— 19%

In sharp contrast, the US cut Pakistan’s tariffs from 29% to 19% following a “landmark” energy partnership deal. This move has been praised by Islamabad as “balanced and forward-looking,” giving Pakistani exports a much-needed competitive edge, especially in textiles.

The Oil-Tariff Tango

Pakistan’s First-Ever US Oil Deal

In a historic shift, Pakistan is set to receive its first-ever shipment of US crude oil—a million barrels of West Texas Intermediate (WTI) crude—by October, diversifying away from its near-total reliance on Middle Eastern oil. Oil is Pakistan’s biggest import, valued at $11.3 billion last year and comprising about 20% of its total import bill.

No Pakistani Oil to India

The current deals and infrastructure make it clear: there’s no oil flowing from Pakistan to Bharat (India). There’s speculation and US push to move surplus Pakistani oil eastwards, but it’s mostly theoretical—Pakistan’s oil market is not currently set up to export to its neighbor.

US Pressure: “Buy 1/4 of Oil from Us”

Part of the broader American strategy appears to require that Pakistan direct at least a quarter of its oil purchases from America. While the specifics are murky, this demand further pulls Islamabad into the US energy orbit.

India’s Bold Retaliation and the F-35 Defense Drama

India Rejects F-35 Stealth Jet Deal

Amid escalating trade tension, India unequivocally rejected the much-hyped US offer to buy Lockheed Martin’s F-35 stealth fighter jets. Officially, the reasons are price (about $80–100 million per unit), high maintenance costs, and incompatibility with India’s Russian-origin military hardware. Unofficially, India resists US tying defense deals to trade war concessions.

No More Big Defense Agreements

India has signaled a freeze on new major defense pacts with the US, ramping up its “Make in India” initiative and tilting closer to local manufacturing and Russian partnerships. This shift reflects deep skepticism after being hit with the 25% tariff and greater pressure to reduce purchases from Russia.

Trump’s Tactics: Threats, Deadlines, and Game Theory

“Just Trump’s Negotiation Tactics”—The Diplomats Say

Analysts and former US diplomats describe the latest moves as textbook Trump: slap on punitive tariffs, broadcast ultimatums, and create a crisis to force countries to the bargaining table. Public deadlines, threats, and “take it or leave it” deals are designed to limit a country’s options and push them into reactive mode.

“Trump’s announcements typically cornered countries with few alternatives: either accept tariffs and damage exports, or come to the table and negotiate… This strategy is high-risk and often seen as unconventional in diplomacy. But for Trump, it worked because it appeared credible.”

Psychological Pressure

Trump structures these negotiations to create pressure points, aiming to achieve quick concessions and avoid drawn-out stalemates. This approach flips negotiation from strategic opportunity to crisis response, leveraging both public optics and loss aversion.

Pakistan’s Irony: Tariffs Down, Tied to US Oil

The “reward” of a 19% tariff for Pakistan is ironic: it comes bundled with the commitment to purchase at least a quarter of its oil from the US—even as America touts “massive oil reserves” in Pakistan, the true extent of which remains unclear. For now, most of the oil will keep flowing into Pakistan, not out of it.

Pakistani officials celebrate the reduction in tariffs, hoping to expand their export footprint and boost economic ties with the US—yet this new dependency on US oil and trade preferences could come with hidden strings and volumes of fine print.

Retaliation and the Regional Ripple Effect

India’s Response: “Safeguard National Interest”

The Indian government, after being bracketed with archrival Pakistan and called a “dead economy,” has declared every intention to protect its interests. Officials are exploring options for countermeasures but are unlikely to enact dramatic retaliation until they’ve fully gauged the tariff’s impact on their export sectors.

Caught in Geopolitical Crossfire

These developments risk driving New Delhi closer to Moscow and Beijing—a scenario that could have far-reaching consequences for US interests in the Indo-Pacific region.

What Happens Next? The SEO and Blogger’s Takeaway

Media Heat and Global Trending

This tit-for-tat drama is generating massive search volumes and news coverage. Terms like “India US tariff war”, “Pakistan 19% tariff”, “F-35 deal rejection”, and “Pakistan US oil import” are red-hot for content marketers and financial bloggers.

Takeaway for Businesses and Analysts

- Indian exporters face tougher times; watch sectors like textiles, pharmaceuticals, auto components, and IT for shocks.

- Pakistani exporters get a breathing room and a competitive edge, but new trade dependencies might emerge.

- The oil trade pattern is shifting: US is now a supplier to Pakistan and trying to leverage that relationship regionally.

- Defense diplomacy is morphing: India is signaling autonomy and a willingness to walk away, even from the world’s stealthiest fighter jet.

Conclusion: The New Normal?

The current scenario sums up the irony and volatility of 21st-century geopolitics: tariffs once meant to punish are now deployed as negotiation bludgeons; defense deals that were once carrots become contentious; and two historic rivals, India and Pakistan, find themselves caught in the wake of an American president’s game-theory-driven power moves.

Whatever the outcome, one thing is clear: both New Delhi and Islamabad, and their global trading partners, are adjusting to a new, sharply transactional era—and the world’s attention is fixed on every twist in the plot.

Trump is Dumb