Donald Trump’s announcement of a 25% tariff on all goods imported from India to the United States, effective August 1, 2025, marks a seismic shift in US-India trade relations. Beyond the numbers, this move signals a complex mix of negotiation tactics, strategic posturing, and deepening global divides. As trade tensions escalate, it’s crucial to dissect Trump’s motives, examine the wider impact, and anticipate what lies ahead for two of the world’s most important economies.

Trump’s Official Statement on India Tariffs

Trump delivered his statement with characteristic bravado, directly accusing India of harboring “the most strenuous and obnoxious non-monetary Trade Barriers of any Country.” He justified the tariff increase by citing India’s “astronomical” tariffs on US products and a long-standing reliance on Russian energy and military hardware. His message was clear:

“Remember, while India is our friend, we have, over the years, done relatively little business with them because their Tariffs are far too high… Also, they have always bought a vast majority of their military equipment from Russia, and are Russia’s largest buyer of ENERGY, along with China… INDIA WILL THEREFORE BE PAYING A TARIFF OF 25%, PLUS A PENALTY FOR THE ABOVE, STARTING ON AUGUST FIRST. THANK YOU FOR YOUR ATTENTION TO THIS MATTER. MAGA!”

This rhetoric reinforces his trademark aggressive negotiation style and plays to a domestic audience attentive to jobs, trade deficits, and perceived foreign “cheating.”

Is This Just a Negotiation Tactic? Decoding Trump’s Playbook

Seasoned observers recognize Trump’s tariff threats as a negotiation tactic—a way to coerce trade partners back to the bargaining table. Trump’s first term saw similar moves against Mexico, China, and the EU, always with the stated goal of “fixing bad deals” or “leveling the playing field.” In nearly every instance, escalation preceded a demand for concessions and, sometimes, last-minute compromise.

This time, the White House set a firm deadline: India must agree to a “fairer deal” by August 1, or higher tariffs take effect. Such brinkmanship puts maximum pressure on India but often leaves US farmers, manufacturers, and consumers exposed to retaliatory pain. Trump’s top trade advisors have admitted that public brinkmanship is meant to extract stronger concessions, but it also risks backfiring if partners refuse to yield.

Trump’s Desperation to Prove His “Dealing Skills”

Amid mixed economic headlines at home, Trump is doubling down on his self-styled image as a master negotiator. Critics argue he is desperate to prove his dealing skills on the world stage and regain control of a stagnant or weakening US trade balance.

The timing of the move—just as campaign season heats up—suggests a focus on optics as much as substance. Trump desperately wants to show American voters and traditional political adversaries that he can extract better deals, even if those victories come with significant collateral damage. The tariff drama with India, much like earlier volleys at China and the EU, is also about reasserting his brand of hard-power deal-making.

Trump’s Duality With India and China: Is It Just Bluff or Strategic Insult?

Despite repeated declarations of friendship with India and personal camaraderie with the Modi administration, Trump has now imposed tariffs nearly as steep as those once levied on China. This reveals a strategic duality or even cynicism: while India’s market is essential for US tech and manufacturing multinationals, Trump groups India with China as a trade rival rather than a special partner.

India’s diplomats expected that their close ties with Washington and China’s much-larger trade surplus would earn them leniency; instead, they face near-equal treatment on key goods. This sends a signal to both Asian giants that the US “America First” agenda trumps friendship. In New Delhi and Beijing, there is an emerging consensus: India and China are not the EU—too powerful and too savvy to be easily manipulated.

Both nations have massive internal markets, burgeoning startup and innovation scenes, and a willingness to absorb short-term pain for long-term sovereignty. They are not, as many American negotiators discovered in Brussels, in a hurry to appease Washington at any cost.

Economic and Political Impact on India

Sectoral Impact

The US is India’s largest export destination—worth nearly $88 billion in 2024. The new 25% tariff directly threatens sectors such as:

- Textiles and apparel: India’s largest exports by volume, these now face losses to Southeast Asian or Central American competitors.

- Pharmaceuticals: Generics and specialty drugs are exposed, with Indian suppliers potentially losing billions.

- Jewelry and precious stones: India’s diamond and gold trade, already under strain from global downturns, faces heavy new US taxation.

- Automotive and parts: A nascent but growing export engine for India, now saddled with major new costs.

- Information technology and outsourcing services: Not directly hit by tariffs, but likely to face new “service taxes” or compliance headaches in response.

GDP and Rupee Reaction

Economists predict India’s exports to the US could shrink 12–18% in the first year, putting hundreds of thousands of jobs at risk, especially in labor-intensive industries and small businesses. The Indian rupee fell sharply against the dollar in early trading after the announcement as investors feared cascading economic impacts.

India’s Response: Bharat is Not the EU to Be Fooled

Indian leaders publicly expressed disappointment but made clear that “core red lines”—protection for agriculture, rural livelihoods, and sovereignty in foreign affairs—will not be breached even under pressure. India’s commerce ministry released a statement saying it is “studying implications” but will “defend Indian interests strenuously.”

Repeated diplomatic messages have made it clear that, unlike some EU nations in past trade rows, India is reluctant to offer quick concessions or enter into an agreement perceived as unfair. Privately, Indian economic ministries are preparing countermeasures and incentive packages for affected exporters.

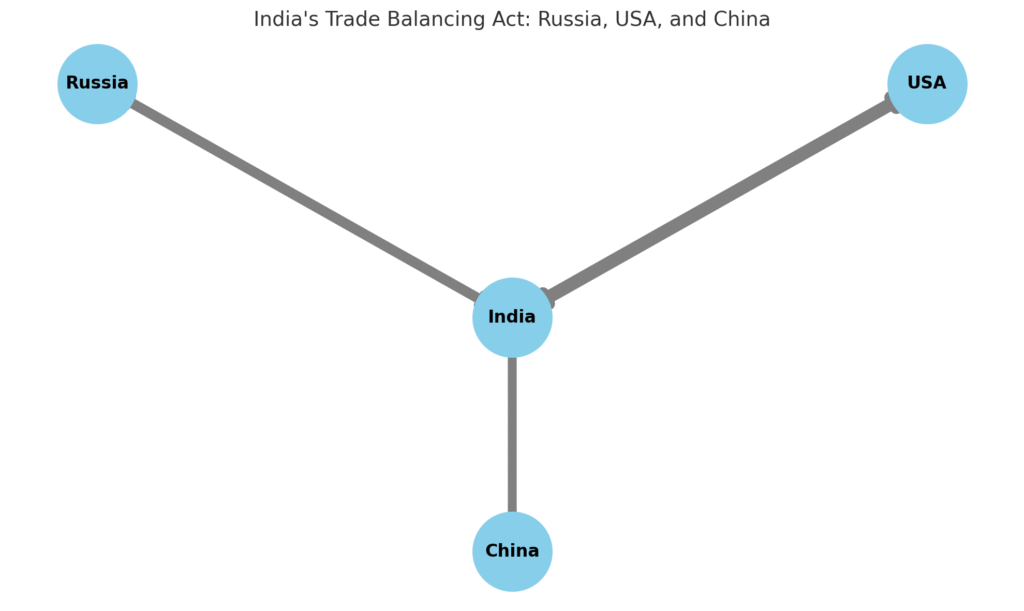

The Russia Angle: Trigger for Penalty

A distinguishing feature of Trump’s tariff threat against India is its explicit linkage to “India’s continued trade and defense dealings with Russia.” As New Delhi has increased Russian oil imports and maintained strong military ties (purchasing S-400s and other equipment), the White House is leveraging tariffs as a punitive tool. Trump has warned that failure to “end ties” with Russia may trigger even steeper penalties. This presents a diplomatic triple-bind for India: balancing US market access, Russian friendship, and its own policy of “strategic autonomy.”

US Duality With India and China: Preferential Treatment Now Over?

While some product exceptions may exist (notably Apple iPhones and select defense deals), the broad application of the new tariff demonstrates that preferential trade treatment is waning. India now finds itself in the same crosshairs as China—and perhaps even at risk of further escalation if it fails to comply with US demands on Russia.

International Reaction: Allies, Adversaries, and the Indo-Pacific

The global response has been swift and anxious. EU business leaders have warned that new US tariffs could further fragment global supply chains and push major economies into tit-for-tat trade wars. In Asia, Vietnam, Indonesia, and Bangladesh are positioning themselves to absorb market share from battered Indian exporters. China, meanwhile, has offered rhetorical support to India, even as it deals with ongoing US tariffs of its own.

Trump’s Indo-Pacific strategy—a supposed centerpiece of his foreign policy—stands at a crossroads. By penalizing India, he risks undermining the “quad” alliance and handing influence to both China and Russia in the region.

What Comes Next? Negotiation Timeline and Potential Outcomes

Short-Term Outlook

- Talks resume: Both sides have agreed to extend negotiations through mid-August, with a narrow window for compromise.

- Business lobbying: Industry groups in both countries are pressuring their governments for exemptions and phased implementation.

- Possible retaliation: While India has not announced reciprocal tariffs, it could target US agricultural and tech exports if talks fail.

Medium-Term Scenarios

- Deal or escalation: If a face-saving deal is struck (on, for example, digital services or agricultural access), tariffs may be reduced or suspended. If not, further rounds of tit-for-tat tariffs and sanctions could follow.

- Supply chain migration: Exporters in India are already exploring alternative markets and cost-saving measures, while US importers scramble for new suppliers.

- Long-term realignment: Both nations may ultimately seek to diversify partners and reduce the risks of over-reliance on a single, volatile market.

Conclusion

Trump’s 25% tariff on Indian goods is not just an economic lever, but a test of global influence, negotiation skill, and the resilience of the world’s largest democracies. Whether it’s a bluff, a genuine economic reset, or simply political theater, the weeks ahead will determine whether confrontation leads to compromise—or to a deeper rift in global commerce and diplomacy.